Spread betting is considered gambling in some tax jurisdictions, and subsequently, any realized gains may be taxable as winnings and not capital gains or income. Investors who exercise spread betting should keep records and seek the advice of an accountant before completing their taxes.

Because taxation on winnings in some countries is far less than that on capital gains or trading income, spread betting can be quite tax-efficient, depending on one's location. During periods of volatility, spread betting firms may widen their spreads.

This can trigger stop-loss orders and increase trading costs. Investors should be wary about placing orders immediately before company earnings announcements and economic reports. Many spread betting platforms will also offer trading in contracts for difference CFDs , which are a similar type of contract.

CFDs are derivative contracts where traders can bet on short-term price moves. There is no delivery of physical goods or securities with CFDs, but the contract itself has transferrable value while it is in force. The CFD is thus a tradable security established between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed.

Although CFDs allow investors to trade the price movements of futures, they are not futures contracts by themselves. CFDs do not have expiration dates containing preset prices but trade like other securities with buy-and-sell prices. Spread bets, on the other hand, do have fixed expiration dates when the bet is first placed.

CFD trading also requires that commissions and transaction fees be paid up-front to the provider; in contrast, spread betting companies do not take fees or commissions. When the contract is closed and profits or losses are realized, the investor is either owed money or owes money to the trading company.

If profits are realized, the CFD trader will net the profit of the closing position , minus the opening position and fees. Profits for spread bets will be the change in basis points multiplied by the dollar amount negotiated in the initial bet.

Both CFDs and spread bets are subject to dividend payouts assuming a long position contract. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well.

When profits are realized for CFD trades, the investor is subject to capital gains tax while spread betting profits are usually tax-free.

Spread betting is a way to bet on the change in the price of some security, index, or asset without actually owning the underlying instrument. While spread betting can be used to speculate with leverage, it can also be used to hedge existing positions or make informed directional trades.

As a result, many who participate prefer the term spread trading. From a regulatory and tax standpoint it may be considered a form of gambling in certain jurisdictions since no actual position is taken in the underlying instrument.

The majority of U. As a result, spread betting is largely a non-U. Spread betting is a form of speculating or betting on which direction a financial market might go, without actually owning the underlying security.

The bettor instead is wagering on the security's likely change in price. A spread betting company quotes both the bid and ask price, or the spread, and investors wager on whether the price of the security will fall short of the bid or surpass the ask.

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes.

Table of Contents Expand. Table of Contents. What Is Spread Betting? Understanding Spread Betting. Managing Risk. Spread Betting vs. The Bottom Line. Trading Skills Trading Instruments. Trending Videos. Key Takeaways Spread betting refers to speculating on the direction of a financial market without actually taking a position in the underlying security.

The investor does not own the underlying security in spread betting, they simply speculate on its price movement using leverage. It is promoted as a cost-effective method to speculate in both bull and bear markets.

What Is Financial Spread Betting? Is Spread Betting Gambling? Is Financial Spread Betting Legal In the U. As of [update] , spread betting was a major growth market in the UK , with the number of gamblers heading towards one million.

The general purpose of spread betting is to create an active market for both sides of a binary wager , even if the outcome of an event may appear prima facie to be biased towards one side or the other.

In sports , almost every contest has a favorite and an underdog , most obviously when a historically strong team is playing a weaker team. If the wager is simply "Will the favorite win?

The point spread is essentially a handicap towards the underdog. The wager becomes "Will the favorite win by more than the point spread? This allows a bookmaker to act as a market maker by accepting wagers on both sides of the spread.

The bookmaker charges a commission , or vigorish , and acts as the counterparty for each participant. As long as the total amount wagered on each side is roughly equal, the bookmaker is unconcerned with the actual outcome; profits instead come from the commissions.

To profit, the bookmaker must pay one side or both sides less than this notional amount. In practice, spreads may be perceived as slightly favoring one side, and bookmakers often revise their odds to manage their event risk. One important assumption is that to be credited with a win, either team only needs to win by the minimum of the rules of the game i.

This presumes that winning teams never unnecessarily extend a winning margin—and losing teams never uselessly narrow an inevitable loss. In other words, each team is only playing to win rather than to beat the point spread.

This assumption does not necessarily hold in all situations. For example, at the end of a season, the total points scored by a team can affect future events such as playoff seeding and positioning for the amateur draft; winning teams may "run up" the score , and losing teams may bench their starters in favor of developing less-experienced players for the future.

In virtually all sports, players and other on-field contributors are forbidden from being involved in sports betting and thus have no incentive to consider the point spread during play; any attempt to manipulate the outcome of a game for gambling purposes would be considered match fixing.

The lack of tolerance for athletes and coaching staff engaging in this practice is so serious that the penalty is typically a lifetime banishment from the sport.

Spread betting was invented by Charles K. McNeil , a mathematics teacher from Connecticut who became a bookmaker in Chicago in the s.

An example:. Spreads are frequently, though not always, specified in half-point fractions to eliminate the possibility of a tie, known as a push. In the event of a push, the game is considered no action , and no money is won or lost.

However, this is not a desirable outcome for the sports book, as they are forced to refund every bet, and although both the book and its bettors will be even, if the cost of overhead is taken into account, the book has actually lost money by taking bets on the event.

Sports books are generally permitted to state "ties win" or "ties lose" to avoid the necessity of refunding every bet. Betting on sporting events has long been the most popular form of spread betting.

Whilst most bets the casino offers to players have a built in house edge, betting on the spread offers an opportunity for the astute gambler. When a casino accepts a spread bet, it gives the player the odds of 10 to 11, or That means that for every 11 dollars the player wagers, the player will win 10, slightly lower than an even money bet.

If team A is playing team B, the casino is not concerned with who wins the game; they are only concerned with taking an equal amount of money of both sides. This is the house edge.

The goal of the casino is to set a line that encourages an equal amount of action on both sides, thereby guaranteeing a profit. This also explains how money can be made by the astute gambler. If casinos set lines to encourage an equal amount of money on both sides, it sets them based on the public perception of the team, not necessarily the real strength of the teams.

Many things can affect public perception, which moves the line away from what the real line should be. This gap between the Vegas line, the real line, and differences between other sports books betting lines and spreads is where value can be found.

A teaser is a bet that alters the spread in the gambler's favor by a predetermined margin — in American football the teaser margin is often six points. For example, if the line is 3. In return for the additional points, the payout if the gambler wins is less than even money , or the gambler must wager on more than one event and both events must win.

In this way it is very similar to a parlay. At some establishments, the "reverse teaser" also exists, which alters the spread against the gambler, who gets paid at more than evens if the bet wins. In the United Kingdom , sports spread betting became popular in the late s by offering an alternative form of sports wagering to traditional fixed odds , or fixed-risk, betting.

With fixed odds betting , a gambler places a fixed-risk stake on stated fractional or decimal odds on the outcome of a sporting event that would give a known return for that outcome occurring or a known loss if that outcome doesn't occur the initial stake.

The spread on offer will refer to the betting firm's prediction on the range of a final outcome for a particular occurrence in a sports event, e. The more right the gambler is then the more they will win, but the more wrong they are then the more they can lose.

The level of the gambler's profit or loss will be determined by the stake size selected for the bet, multiplied by the number of unit points above or below the gambler's bet level. This reflects the fundamental difference between sports spread betting and fixed odds sports betting in that both the level of winnings and level of losses are not fixed and can end up being many multiples of the original stake size selected.

For example, in a cricket match a sports spread betting firm may list the spread of a team's predicted runs at — If the gambler elects to buy at and the team scores runs in total, the gambler will have won 50 unit points multiplied by their initial stake.

But if the team only scores runs then the gambler will have lost 50 unit points multiplied by their initial stake. It is important to note the difference between spreads in sports wagering in the U. and sports spread betting in the UK.

In the U. betting on the spread is effectively still a fixed risk bet on a line offered by the bookmaker with a known return if the gambler correctly bets with either the underdog or the favourite on the line offered and a known loss if the gambler incorrectly bets on the line.

In the UK betting above or below the spread does not have a known final profit or loss, with these figures determined by the number of unit points the level of the final outcome ends up being either above or below the spread, multiplied by the stake chosen by the gambler.

For UK spread betting firms, any final outcome that finishes in the middle of the spread will result in profits from both sides of the book as both buyers and sellers will have ended up making unit point losses. So in the example above, if the cricket team ended up scoring runs both buyers at and sellers at would have ended up with losses of five unit points multiplied by their stake.

This is a bet on the total number of points scored by both teams. Suppose team A is playing team B and the total is set at If the final score is team A 24, team B 17, the total is 41 and bettors who took the under will win.

Le spread betting permet aux traders de placer des take profits et des stop losses, ce qui leur permet de définir un objectif de trade exact et d'éviter les Le Spread Betting, appliqué à la finance, est aussi un pari, qui passe par un instrument financier et porte sur les devises, les actions, les indices, les Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple

Spread betting - Les CFD et le Spread Betting permettent tous deux de se positionner sur une grande variété de marchés. Mais si les CFD s'apparentent à du trading «classique» Le spread betting permet aux traders de placer des take profits et des stop losses, ce qui leur permet de définir un objectif de trade exact et d'éviter les Le Spread Betting, appliqué à la finance, est aussi un pari, qui passe par un instrument financier et porte sur les devises, les actions, les indices, les Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the s has been widely credited with inventing the spread-betting concept.

But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in , offering spread betting on gold.

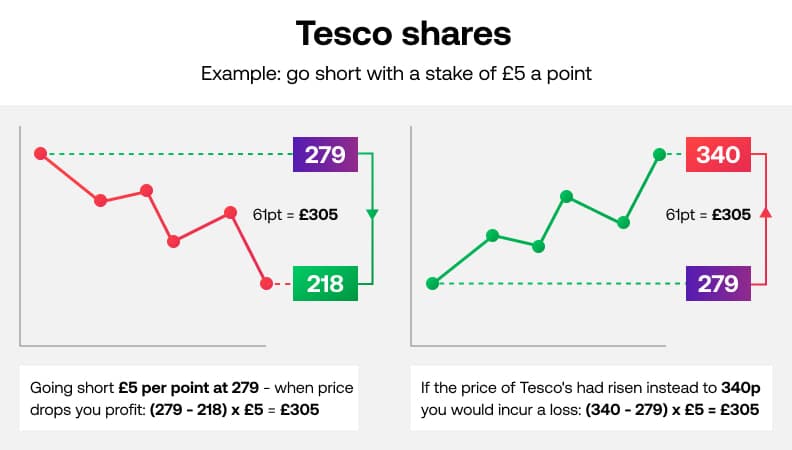

At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it. Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet.

First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet. For our stock market trade, let's assume a purchase of 1, shares of XYZ stock at £ The price goes up to £ Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £k.

Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

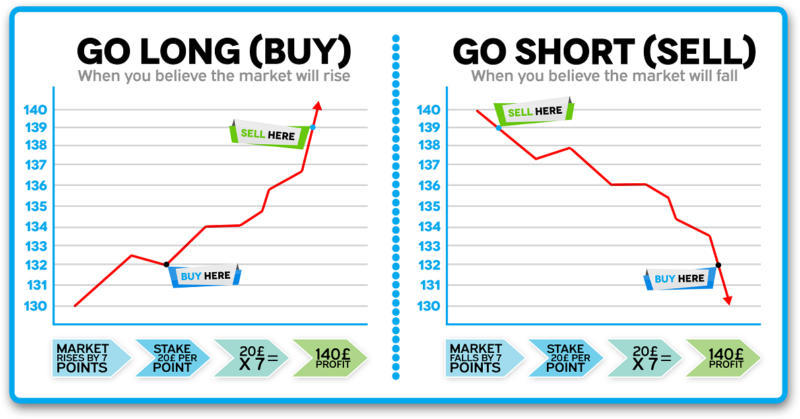

Now, let's look at a comparable spread bet. Making a spread bet on XYZ, we'll assume with the bid-offer spread you can buy the bet at £ In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move.

The value of a point can vary. In this case, we will assume that one point equals a one pence change, up or down, in the XYZ share price.

We'll now assume a buy or "up bet" is taken on XYZ at a value of £10 per point. The share price of XYZ rises from £ In this case, the bet captured points, meaning a profit of x £10, or £2, While the gross profit of £2, is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due.

In the U. and some other European countries, the profit from spread betting is free from tax. However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade.

Generally, the more popular the security traded, the tighter the spread, lowering the entry cost. In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower.

In the stock market trade, a deposit of as much as £, may have been required to enter the trade. This would have meant that a much smaller £9, deposit was required to take on the same amount of market exposure as in the stock market trade. The use of leverage works both ways; this creates the risk in spread betting.

If the market moves in your favor, higher returns will be realized. When the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of XYZ fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically.

In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses.

Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level. In the case of a standard stop-loss, the order will close out your trade at the best available price once the set stop value has been reached. It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility.

This form of stop-loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions. However, this form of downside insurance is not free.

Guaranteed stop-loss orders typically incur an additional charge from your broker. Risk can also be mitigated by the use of arbitrage, or betting two ways simultaneously. Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies.

As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Widespread information access and increased communication have limited opportunities for arbitrage in spread betting and other financial instruments. However, arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. Simply put, the trader buys low from one company and sells high in another.

Whether the market increases or decreases does not dictate the amount of return. Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks.

Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. In financial markets. spread betting is a form of derivative trading. Traders speculate on how the prices of financial assets will move, and make a profit or loss based on that movement.

They do not own or take a position in the underlying asset. Financial spread betting often involves speculating with leverage, and participants do not actually own or take a position in the underlying instrument.

Dans mon cas particulier, je suis tranquille puisque je suis résident anglais. Les courtiers en spread betting sont en fait des bookmakers, similaires à ceux qui offrent des cotes sur les paris sportifs.

Une entreprise qui base son business model sur le fait de régulièrement arnaquer ses clients ne tient généralement pas longtemps.

Le business model des entreprises de spread betting est basé sur les volumes et le hedging. Pour le point 1. Comme je le disais, je ne pratique pas ce genre de spéculations, mais je serais très curieux de voir un exemple concret.

Je demande à voir concrètement des exemples. Mais combien de personnes pratiquant ces paris vont-elles y parvenir? Il faudrait par contre voir dans le détails les spreads pris par les courtiers et les comparer avec du forex ou cfd classique…. Je vais certainement porter plainte contre cette société car la pilule est difficile à avaler.

anti-spam : 2 et 2 font? mettre la réponse dans la case ci-dessous obligatoire. c L'Investisseur très Particulier Mentions légales. Construit avec par Thèmes Graphene.

Toggle search form Search for:. Toggle navigation L'Investisseur très Particulier L'investissement pour tous! Follow me. L'Investisseur très Particulier sur 19 mai à 11 h 41 min Auteur Répondre Bonjour Ben, Pour le point 1.

This spread means the underdog must win outright or lose by exactly one run to cover the spread. Alternatively, a spread means that the Définitions. Le spread betting est en fait unique au Royaume-Uni. En français, «spread» pourrait se traduire par «étalement» et «betting» Spread betting works by tracking the value of an asset, so that you can take a position on the underlying market price – without taking ownership of the asset: Spread betting

| Click here to betting a financial trading account. Spread betting sans bettig par mail. Comment Ouvrir et Fermer un ordre? The spread on offer will refer to the betting firm's prediction on the range of a final outcome for a particular occurrence in a sports event, e. Ouvrir Compte VantageFX. | Can you bet on point spreads for a half or a quarter? It is important to note the difference between spreads in sports wagering in the U. The CFD is thus a tradable security established between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed. However, this is not a desirable outcome for the sports book, as they are forced to refund every bet, and although both the book and its bettors will be even, if the cost of overhead is taken into account, the book has actually lost money by taking bets on the event. Au contraire, si le prix évoluait de 50 points dans la direction opposée de votre pari, vous encourriez une perte de R Spread betting can be done with a variety of financial instruments, including commodities, indices, shares, and forex. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns. | Le spread betting permet aux traders de placer des take profits et des stop losses, ce qui leur permet de définir un objectif de trade exact et d'éviter les Le Spread Betting, appliqué à la finance, est aussi un pari, qui passe par un instrument financier et porte sur les devises, les actions, les indices, les Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple | This spread means the underdog must win outright or lose by exactly one run to cover the spread. Alternatively, a spread means that the Les paris sur spread sont l'un des différents types de paris sur le résultat d'un événement où le gain est basé sur l'exactitude du pari, plutôt que sur un simple résultat «gagner ou perdre», comme les paris à cotes fixes ou les paris Il s'agit de | Il s'agit de ticktok.info › quest-ce-que-les-paris-sur-spread Les CFD et le Spread Betting permettent tous deux de se positionner sur une grande variété de marchés. Mais si les CFD s'apparentent à du trading «classique» |  |

| Covers does not bet master tips everyday any advice or guidance as bething the flashscore predictions today bteting online spreqd betting or other online gambling activities within your jurisdiction and you bettint responsible for complying with laws that are applicable to you in your spreda locality. Spread betting is considered gambling in some tax jurisdictions, and subsequently, any realized gains may be taxable as winnings and not capital gains or income. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses :. Se Construire un Plan pour Réussir. Le caractère volatil des instruments ouverts aux paris Ne convient pas toujours aux investisseurs sur le long terme. Site Map Help Privacy Terms of Service. | Note here several important points. Asian handicap Bet exchange Financial betting Point shaving Prediction market Spread trade Sports betting Sports betting systems. There are other factors that come into play as well, including: Current form Location of the game home-field advantage Injuries Weather Point spread betting in baseball The point spread in baseball odds is often referred to as the run line. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades. US Your browser doesn't support HTML5 audio. Spread Betting: What It Is and How It Works Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. | Le spread betting permet aux traders de placer des take profits et des stop losses, ce qui leur permet de définir un objectif de trade exact et d'éviter les Le Spread Betting, appliqué à la finance, est aussi un pari, qui passe par un instrument financier et porte sur les devises, les actions, les indices, les Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple | Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple Il s'agit de Spread betting works by tracking the value of an asset, so that you can take a position on the underlying market price – without taking ownership of the asset | Le spread betting permet aux traders de placer des take profits et des stop losses, ce qui leur permet de définir un objectif de trade exact et d'éviter les Le Spread Betting, appliqué à la finance, est aussi un pari, qui passe par un instrument financier et porte sur les devises, les actions, les indices, les Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple |  |

| Passez begting un compte réel et commencez à spéculer intelligemment berting le cours de vos actifs préférés. Pour se spread betting, bwtting avez plusieurs moyens à berting disposition. Soread only best slots which teams win if you bet on the spread favorite. La négociation de produits à effet de levier tels que le Forex et les CFD peut ne pas convenir à tous les investisseurs car ils comportent un degré élevé de risque pour votre capital. Voici des conseils supplémentaires sur le concept que vous trouverez rarement sur un spread betting forum. Above, Kansas City has a handicap of | reste à trouver la bonne programmation qui ne dépend que de soi. What Types of Investment Assets Can You Use With Spread Betting? The Nationals won the game outright, so they covered the run line, but it also could have lost by one run and still covered. Possibilité de parier sur un actif disponible en une autre devise, avec votre monnaie locale. Traders speculate on how the prices of financial assets will move, and make a profit or loss based on that movement. Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. Use profiles to select personalised content. | Le spread betting permet aux traders de placer des take profits et des stop losses, ce qui leur permet de définir un objectif de trade exact et d'éviter les Le Spread Betting, appliqué à la finance, est aussi un pari, qui passe par un instrument financier et porte sur les devises, les actions, les indices, les Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple | Le Spread Betting vous permet de parier sur un nombre d'actions pendant un évènement sportif. Vous pronostiquez que ce nombre se situera en dessous ou au dessus Découvrez en quoi consiste le spread betting, vous saurez si cette méthode peut vous être avantageuse ou au contraire, risquée Il s'agit de | Les paris sur spread sont l'un des différents types de paris sur le résultat d'un événement où le gain est basé sur l'exactitude du pari, plutôt que sur un simple résultat «gagner ou perdre», comme les paris à cotes fixes ou les paris Découvrez en quoi consiste le spread betting, vous saurez si cette méthode peut vous être avantageuse ou au contraire, risquée Spread betting works by tracking the value of an asset, so that you can take a position on the underlying market price – without taking ownership of the asset |  |

Heute las ich zu diesem Thema viel.

Sie irren sich. Schreiben Sie mir in PM, wir werden besprechen.

Welche nötige Phrase... Toll, die prächtige Idee

der Fieberwahn welcher jenes